2022 Inflation

Reduction Act

Money-Saving HVAC Federal Tax Credits and Rebates

Helping Homeowners

Save Money

On August 16, 2022 the U.S. government signed into law the Inflation Reduction Act (IRA) in an effort to reduce greenhouse gas (GHG) emissions by 40% by 2030. As part of the Inflation Reduction Act, homeowners have access to cost-saving options for purchasing energy efficient and electric appliances or making home improvements to electrify their home or increase its energy efficiency.

How Homeowners Can Save on Their HVAC Equipment

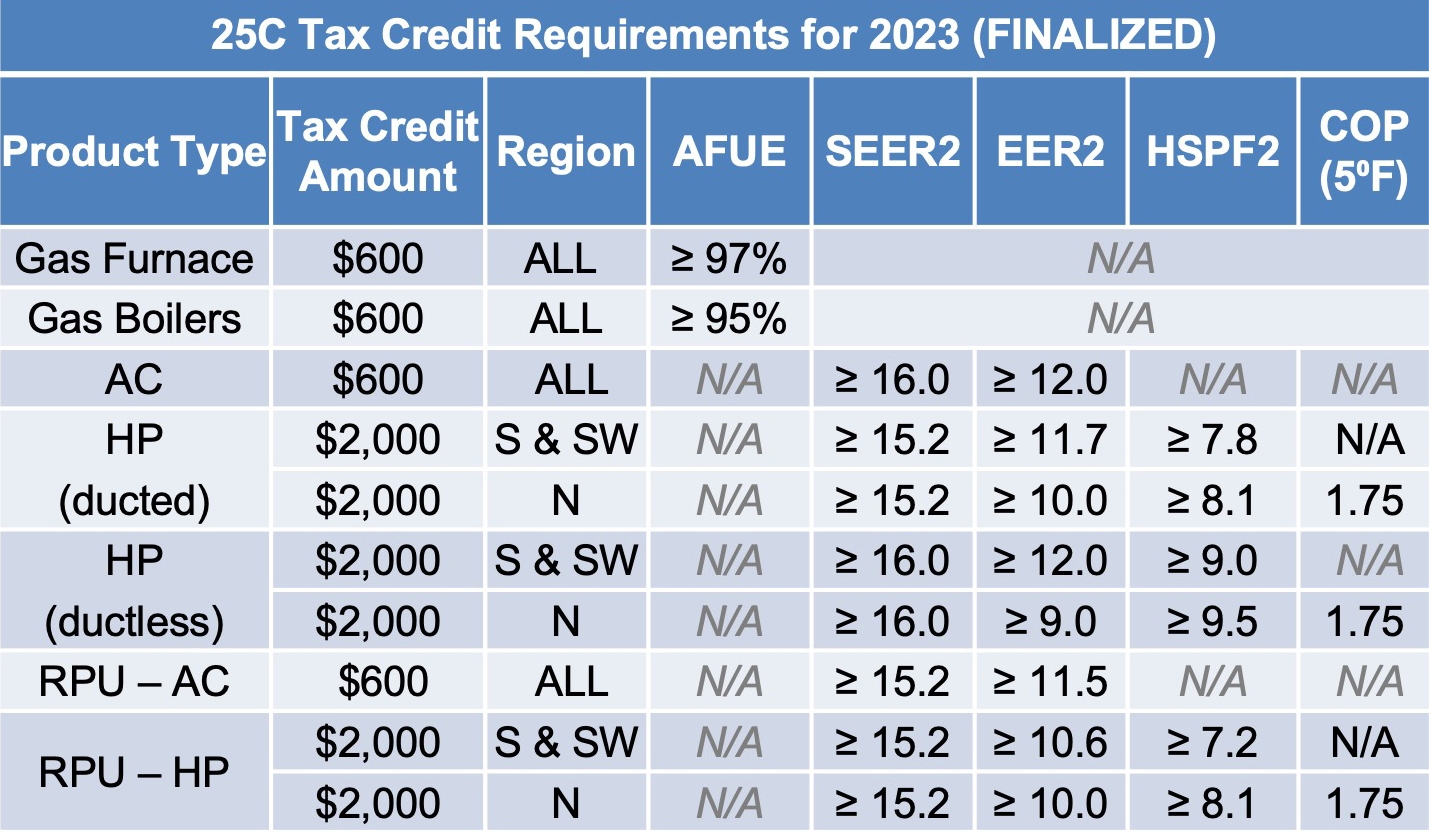

The Energy Efficient Home Improvement Tax Credit (25C) provides a federal tax credit to homeowners who install high-efficiency equipment, this includes HVAC equipment. The previous Nonbusiness Energy Property credit of up to $500 was extended through 2022. The amended Energy Efficient Home Improvement Credit , which begins in 2023 and extends through 2032, increases the tax credits as high as $600 for qualified air conditioner or gas furnace, and up to $2000 for qualified heat pump, heat pump water heater or boiler.

Efficiency Home Improvement Energy Tax Credit (25C)

The previous Nonbusiness Energy Property credit (25C) for installing high-efficiency equipment was extended through 2022 and provides federal tax credits of up to $500.

The amended Energy Efficient Home Improvement Credit (25C) begins in 2023 and extends the offering through 2032. It increases the tax credit limits for high-efficiency equipment as follows:

- Up to $600 each for a qualified air conditioner or gas furnace, with an annual cap of $1,200

- Up to $2,000 with a qualified heat pump, heat pump water heater, or boiler.

What HVAC Products Are Eligible For The 25C Tax Credits in 2023?

A broad selection of high efficiency heating and cooling equipment is eligible for the tax credits. Many of Lennox products ranging from air conditioners and heat pumps to gas furnaces and mini-splits qualify for the 25C tax credit.

To simplify your search for eligible equipment, check out the Credits and Rebates section on the AHRI Matchup Tool. You can filter indoor and outdoor equipment by 25C tax credit eligibility. The results page will display a dedicated column for the 25C tax credit, highlighting potential savings for each piece of equipment to help homeowners make informed buying decisions about their energy-efficient upgrades.

2023 HVAC Tax Credit Amendment

- The 25C federal tax credit was amended for 2023 and will remain effective until Dec. 31, 2032.

- Amendments include:

- 30% of cost up to $600 (or $2,000 for HPs)

- Gas furnace and air conditioner can be combined for a total credit up to $1,200.

- Qualifying units meet or exceed the highest efficiency tier that is not the advanced tier.

Check here for 2024 25C qualifying equipment

Click here to understand tax savings of the 25C Tax Credit

How Can I Help Homeowners Take Advantage?

If you have installed new, high-efficiency equipment for customers on or after January 1, 2022, view the Tax Credit Certificates above to confirm which products qualify for the HVAC tax credit. You can then add value and build trust by proactively contacting those homeowners to let them know that they qualify for a tax credit. Simply direct them to the Lennox.com HVAC tax credit page to download the relevant tax qualification certificate, then encourage them to consult their tax professional to confirm eligibility and submit the certificate with their federal tax return to receive the credit.

For homeowners interested in replacing or repairing their HVAC system, walk them through the Lennox lineup of innovative, energy-efficient home comfort solutions that qualify for these programs. On this page of LennoxPros.com you can find the list of products that qualify for 25C federal tax credits up to $500 in 2022 and up to $2,000 beginning in 2023.

How Does Lennox

Fit In?

With the new rebate program and extended tax credits, there’s no better time for you to sell and inform homeowners about the Lennox lineup of innovative, energy-efficient home comfort solutions.

Lennox boasts a broad assortment of ENERGY STAR® qualifying products eligible for these programs – including but not limited to the Dave Lennox Signature® Collection SL25XPV, the most efficient heat pump on the market with a SEER rating up to 24, the SL28XCV, the most efficient air conditioner on the market with a SEER rating up to 28, and the SLP99V, the most efficient furnace on the market boasting an efficiency rating of up to 99%.

Lennox Industries Inc. (“Lennox”) is not acting in the capacity of a legal or tax advisor and does not make any representation, warranty, guarantee or other assurance as to whether a particular matchup qualifies or is eligible for a tax credit or rebate. This document has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax or legal advice. The IRS, DOE, and state energy offices are responsible for the implementation and administration of tax certificates/rebates. There are important requirements and limitations for the homeowner to qualify for tax credits/rebates. Moreover, the laws are subject to change. As a result, Lennox highly recommends that you and your customers consult with a tax advisor or attorney regarding a homeowner’s qualification for a tax credit/rebate in their particular circumstance and verify and review the applicable laws and regulations. Lennox expressly disclaims all liability for damages of any kind arising out of a homeowner’s claim for a tax credit/rebate. This information is subject to change without notice.